TDECU Savings Accounts

A range of savings accounts to help you safely and securely reach your financial goals

New to TDECU?

Start off right when you apply online as a new Member. We will deposit $5.00 directly into your Share Savings Account to help you start your savings journey.

Why a savings account?

A savings account is a powerful financial tool. It can help curb your temptation to spend, protect you from financial difficulties, and help prepare you to make a big-ticket purchase like a home or a car. With the right savings account and a plan to move money into the account each month, you can enjoy financial stability for years to come.

TDECU Savings Accounts feature these benefits:

to

0.99%

Interest Rate Paid Monthly

to

1.00%6

Annual Percentage Yield (APY)

$0

Monthly Maintenance Fee3

Compare saving accounts

A wide range of options to help you meet your savings goals.

Share Savings

An interest bearing-savings account that makes you a TDECU Member.

$5.00

Opening Deposit

$0.00

Minimum Balance

Club Savings

A secondary savings account to help you save for a specific goal.

$1.00

Opening Deposit

$0.00

Minimum Balance

Savings IRA

An individual retirement account that enables you to set aside some of your earnings towards retirement.

$0.00

Opening Deposit

$0.00

Minimum Balance

Studio 55+ Club

A savings account that offers exclusive benefits for TDECU Members ages 55 and better.

$5.00

Opening Deposit

$5.00

Minimum Balance

Kids Savings Accounts4

Kid-friendly accounts with grown up features so they can save just like you.

Kids Club Savings Account

A savings account designed for kids ages 4-12.

$5.00

Opening Deposit

$5.00

Minimum Balance

Teen Savings

A savings account to help develop solid financial habits for teens ages 13-17.

$5.00

Opening Deposit

$5.00

Minimum Balance

TXUTMA Savings

A custodial account to save for your child's future.

$5.00

Opening Deposit

$5.00

Minimum Balance

Certificate of Deposit (CD)

12 Months

APY1

18 Months

30 Months

60 Months

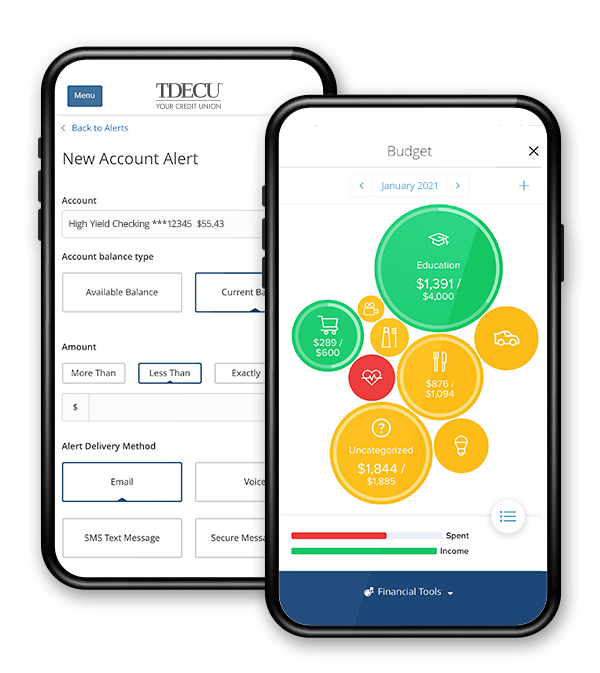

Manage your savings on the go

- Automate your savings by setting up recurring transfers

- Set and track your financial goals with Financial Tools

- Deposit checks directly from your mobile device

- Access your account statements from anywhere, at anytime

Savings Accounts FAQs

What types of savings accounts does TDECU offer?

TDECU offers a variety of savings accounts, including Share Savings, Club Savings, Savings IRA, Studio 55+ Club, Kids Club Savings Account, Teen Savings, and TXUTMA Savings, along with Certificates of Deposit (CDs) options with various rates and terms.

How can a new Member start their savings journey with TDECU?

A new Member can start their savings journey with TDECU by applying online. TDECU will deposit $5.00 directly into your Share Savings Account as a starting point upon joining.

What are the benefits of TDECU Savings Accounts?

Benefits include up to 0.99% interest rate paid monthly, up to 1.00% Annual Percentage Yield (APY), and $0 monthly maintenance fees.

What is the minimum deposit required to open a savings account at TDECU?

The minimum deposit required varies by account type: Share Savings, Kids Club Savings, Teen Savings, and Studio 55+ Club accounts require a $5.00 opening deposit, Club Savings and Teen Checking require a $1.00 opening deposit, and Savings IRA have a $0.00 opening deposit requirement.

Can I open a savings account for my child at TDECU?

TDECU offers kid-friendly savings accounts, such as the Kids Club Savings Account for ages 4-12 and Teen Savings for ages 13-17, designed to help them develop solid financial habits.

Are there any monthly maintenance fees for TDECU savings accounts?

No, TDECU savings accounts feature $0 monthly maintenance fees, making it easier for Members to save without worrying about additional costs. Subject to account and penalty fees. See Fee Schedule.

How does TDECU's Certificate of Deposit (CD) work, and what APYs are available?

TDECU's Certificate of Deposit (CD) allows Members to earn more interest than traditional savings accounts by choosing a term that fits their needs, with APYs up to 3.75% for 12 months, 3.50% for 18 months, 2.25% for 30 months, and 2.40% for 60 months. Rates subject to change. APYs as of 12/31/24.

Are there any federal limitations on transfers or withdrawals from TDECU savings accounts?

No. Federal regulations used to limit limit the number of transfers or withdrawals from a savings account to six per calendar month via fax, telephone, online, ACH, or overdraft. However, that was changed in 2020.

1APY = Annual Percentage Yield.

2Must be at least 18 years of age to open a High-Yield Checking (HYC) account with a limit of one account per Member. Requirements to earn highest APY include enrollment in eDocuments, recurring direct deposit with an aggregated total of $500 or more per month that posts to your HYC account, and a minimum of 10 debit card point-of-sale withdrawal transactions of $1 or more per month. Highest APY includes 1.00% on HYC balances ≤$20,000; 0.25% on HYC balances >$20,000; 1.00% APY on primary savings balances ≤$50,000; 0.25% APY on primary savings balances >$50,000. If requirements are not met, accounts will earn an APY of 0.02% on HYC balances and 0.10% on primary savings balances. Account-holders will receive a maximum rebate of $30 per month on non-TDECU ATM fees. Other terms/conditions apply. Contact TDECU for complete details.

3Subject to account and penalty fees. See Fee Schedule.

4Kids Club Savings Account require a parent or guardian TDECU Member who is 18 years or older to be on the account with the child. Teens aged 13-17 are eligible to open a savings account at one of TDECU's Member Centers without a parent or guardian. Other terms/conditions apply. Contact TDECU for complete details.

5APYs are accurate as of 12/31/24. Rates are subject to change without notice. An early withdrawal penalty will be imposed for CD withdrawals made before maturity. Refer to your original CD agreement for additional terms & conditions. A minimum balance is required to earn the advertised annual percentage yield. Fees may reduce earnings.

6Up to 1.00% APY requires a Membership and a a High-Yield Checking (HYC) account that meets eligible requirements. Other terms/conditions apply. Contact TDECU for complete details.

APYs are accurate as of 12/31/24 for CDs and 4/10/24 for savings and checking accounts. Rates are subject to change without notice.

Refer to TDECU’s Member Handbook & Truth in Savings Brochure for additional terms and conditions.