Own Your Financial Future

At TDECU, you’re more than just a member—you’re an owner. As a not-for-profit credit union, we prioritize you. That means better rates, fewer fees, and a focus on what matters most: helping you navigate your financial journey.

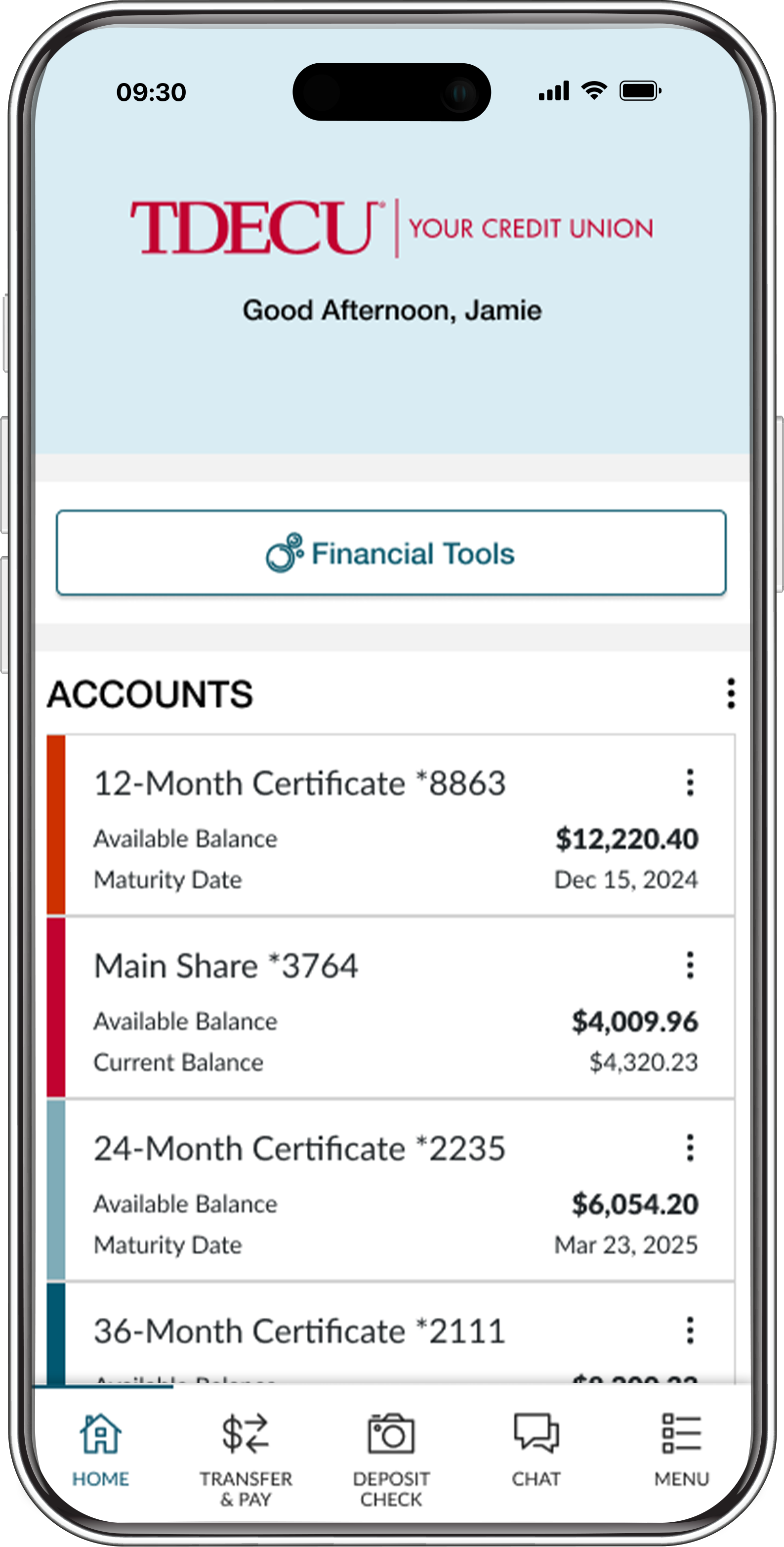

Digital BankingBanking in your pocket

With TDECU Digital Banking, you can:

-

Access your account balances and history

-

Transfer money between accounts

-

Track spending and create budgets

Your TDECU Membership awaits – verify your application status.

Curious about your standing? Check your Membership application now!