Mobile Check Deposit from TDECU

Deposit checks directly from your mobile device

Save time and skip a trip to a Member Center

Believe it or not, paper checks are still a part of everyday banking. Whether you receive the highly regarded birthday check from your grandparents, or a printed paycheck from your work, a paper check may pop up from time to time. Fortunately, with mobile check deposit, you can deposit your paper check without making a trip to your local Member Center.

Get started with mobile check deposit today!

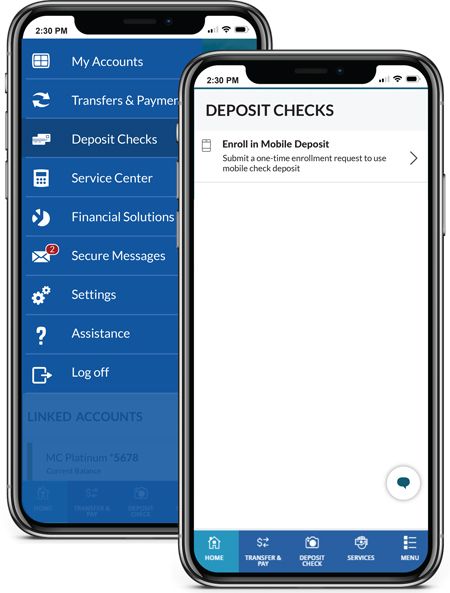

Part 1 - Enroll

- Download the TDECU Digital Banking app to your smartphone or tablet.

- Log in to your account.

- Tap on Menu.

- Tap on Deposit Checks.

- Tap on Enroll in Mobile Deposit.

- Review and agree to our terms and conditions.

We review and process enrollment requests within two business days. Keep an eye on your secure message inbox for updates!

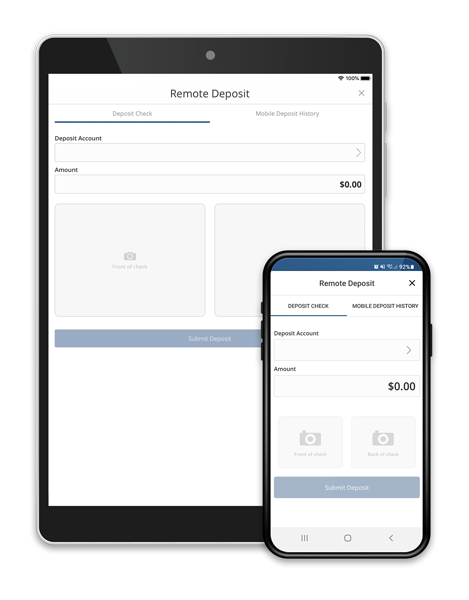

Part 2 - Deposit your check

- Tap on Deposit Checks.

- Tap on Make a Deposit.

- Select your deposit account and enter the check amount.

- Endorse your check. See 'Endorsements and Procedures' section within the 'terms and conditions' document for proper check endorsements.

- Capture a photo of the front and back of your check.

- Submit!

Mobile Check Deposit Frequently Asked Questions

What is mobile check deposit?

Mobile check deposit allows you to deposit your checks remotely, using the TDECU Digital Banking app. With the app, you can take a picture of the front and the back of an endorsed check and deposit it directly into your TDECU account.

Do I need the TDECU Digital Banking app to use mobile check deposit?

Yes. You must download the TDECU Digital Banking app to your mobile device. Once downloaded, you can use mobile check deposit on your iOS or Android smartphone or tablet.

Why do I have to enroll to use the mobile check deposit service?

While we would love to approve everyone for the service, you must meet several requirements to use mobile check deposit. These requirements include length of Membership, deposit account balances, loan payment history, non-sufficient funds history, and the type of account(s) you have with TDECU.

If you have specific questions about these requirements, please send us a secure message through the digital banking app or call us at (800) 839‑1154.

Will my funds be available immediately after I complete my mobile check deposit?

Mobile check deposits are generally made available within 24-48 business hours (this excludes weekends and federal holidays) from the day they are approved. If your mobile check deposit is approved before 6:30 p.m. CST on a business day we are open, we consider that day to be the day of your deposit. If not, the date of your deposit will be considered the next business day we are open.

We may make funds available sooner based on your relationship with TDECU and transaction information. Please review our terms and conditions for more information.

What do I need to include on the back of my check before taking a photo?

Before you take a picture of your check, make sure to sign the back of your check, include your account number, and write For TDECU Mobile Deposit Only. See the 'Endorsement and Procedures' section of 'terms and conditions' for info on a proper endorsement.

How will I know if my mobile check deposit was submitted successfully?

The TDECU Digital Banking app should display a confirmation message after submitting your mobile check deposit. In addition, you will receive updates via email informing you whether the deposit was accepted.

Are there deposit limits?

How can I ensure my check can be read in a photo?

Do I need to hold on to my paper check after submitting the deposit?

Can TDECU return a deposit after sending confirmation?

Download our Mobile Check Deposit Terms and Conditions