TDECU Personal Line of Credit

Be prepared for anything with a Cash $tash® Line of Credit

Looking for a personal loan?

- Terms up to 84 months

- Zero collateral loans available

- Competitive interest rates

Get approved for the cash you need — but only pay interest on what you use*

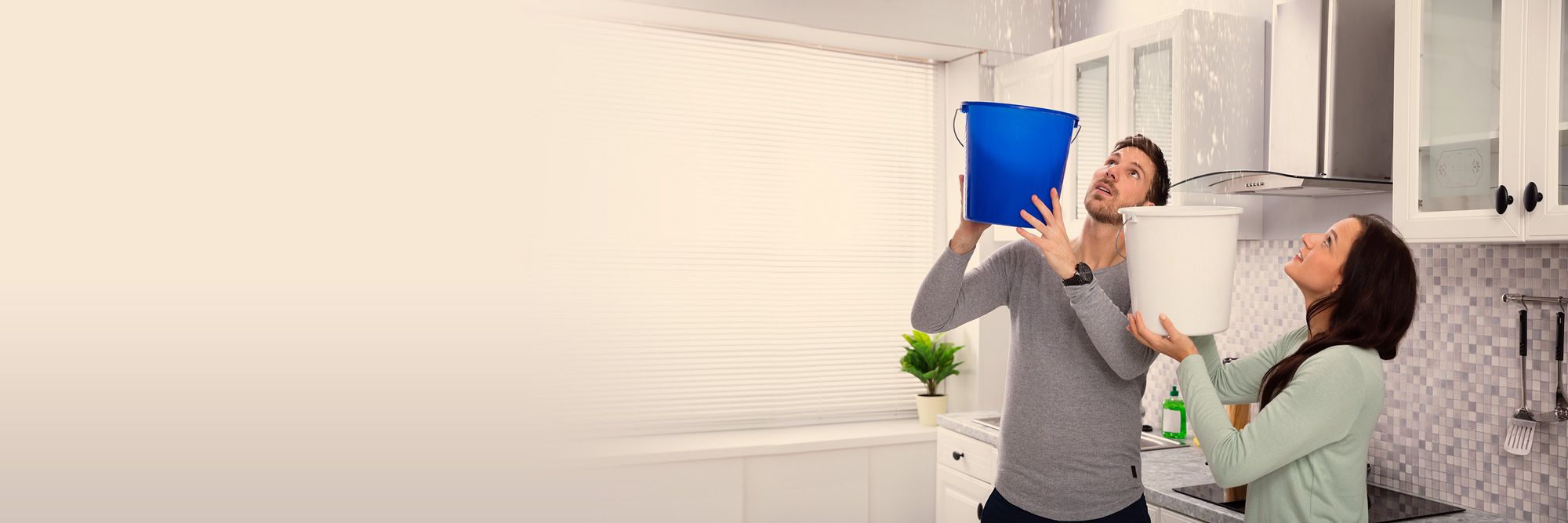

A line of credit can be used for anything you need, but it is especially helpful for things like wedding planning (with its unforeseen or varying costs), unplanned life events, or sudden income gaps. With a line of credit to borrow against, you can spend what you need when you need it.

The Cash $tash® Line of Credit from TDECU features these benefits:

low as

9.74%

APR1

up to

$50,000

Zero

Collateral Required

TDECU Personal Line of Credit Frequently Asked Questions

What is the difference between a personal loan and a line of credit?

A personal loan will begin accruing interest on the full loan balance right away, and the monthly payment will be a fixed amount over the loan’s term.

A line of credit will not accrue interest until you withdraw funds, and you will only be charged interest on the funds you withdraw.

I am going to need ongoing access to funds. Should I take out a line of credit?

Yes. A line of credit is a revolving credit account that allows you to draw funds up to your approved limit. It is for borrowing money as needed, without having to take the full amount in one lump-sum payment.

I am not sure how much I want to borrow. Would a line of credit or personal loan be better for me?

If you are not sure how much you want to borrow, a line of credit is a smart choice. With a line of credit, you are approved to borrow a predetermined amount of money. You withdraw funds against that limit as needed. Also, you only pay interest on the funds you withdraw.

A personal loan is paid in one lump-sum payment. Unlike a line of credit, you pay interest on the full amount of the loan, no matter how much of it you spend.

Can I get a line of credit online?

What does “line of credit available” mean?

What does “maximum line of credit available” mean?

Ready to apply for your new line of credit?

Start our easy approval process today online, in person, or over the phone

- Apply for a personal line of credit online - Apply Now

- Visit a Member Center - Find a Location

- Give us a call - (800) 839-1154

*Account must be in good standing. Proof of income and credit approval required. Offers subject to change/end without notice and at sole discretion of TDECU. Other terms/conditions may apply; contact TDECU for details.

1APR = Annual Percentage Rate. Rates are based on amount borrowed and approved credit (determined by your credit score). Advertised rates include a 0.25% discount for a recurring direct deposit of $250 or more.

Terms of repayment: A Cash $tash LOC balance of $1,000 or less equals a $20 monthly payment; a Cash $tash LOC balance of more than $1,000 equals a monthly payment of 2% of the current balance.