TDECU Help Center

Questions? We have answers!

Security & Fraud

Digital Services

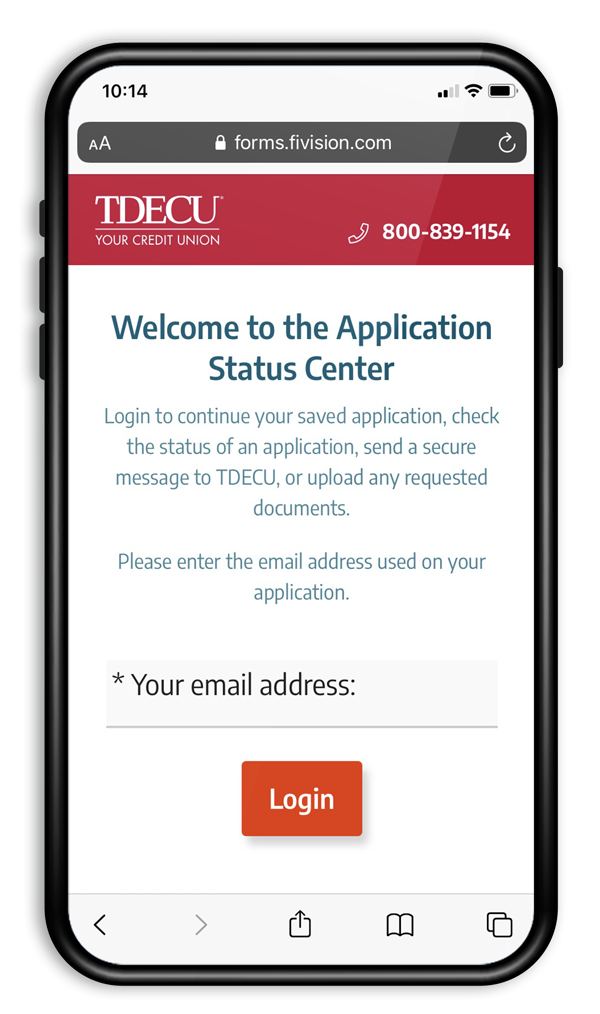

Application Status

Check the status of your new account, loan or credit card application.Mobile Check Deposit

Learn how to deposit your checks with your mobile device.eDocuments

Learn how to receive paperless statements and documents.Mobile Pay

Link your TDECU card and start making payments from your mobile device.Top Frequently Asked Questions

How do I report my card lost or stolen?

- Log into TDECU Digital Banking

- Click on Service Center from the Navigation Menu

- Click on Manage Cards

- Tap on a card or click on Card Details

- Click on Report Lost or Stolen

- You must complete a short questionnaire when reporting a card lost or stolen. This information will alert TDECU of any potential fraud on the account.

- Once submitted, your card will be permanently deactivated. TDECU will mail a new credit card to your current address on file. To receive a new debit card, send a secured message via Digital Banking, call Member Care, or visit your nearest branch.

- Once you report your card lost or stolen, the card will appear in a Lost or Stolen status within Digital Banking. When you log back in, the card will no longer appear in the Card Management module.

How do I temporarily disable my Debit Card or Credit Card?

- Log on to Digital Banking

- Select the Service Center button

- Click on the Manage Cards option.

- You can then select the option to disable your card temporarily.

How can I update my address and contact information?

You can update your address, phone number and email address, one of two ways: (1) submit your updated information using the My Profile form in Digital Banking, or (2) call us at (800) 839-1154 for assistance.

Can I reset my Digital Banking password?

Yes! You can reset your password by clicking on the Forgot Password option, located directly under the login fields on either the desktop or mobile app. From the Forgot Password screen:

- Enter your username.

- Click on submit.

- Select the delivery method to receive your secure access code.

- Enter your secure access code into the provided field.

- Create your new digital banking password.

If you currently don’t have a username (that is not your Member number), you can create one by following these steps:

- Log in to TDECU Digital Banking.

- Click on Settings.

- Click on Security Preferences.

- Click on Change Username.

- Enter your new username.

- Click on Save.

I can’t remember my Digital Banking username. Is there a way to retrieve it?

Yes! You can recover your username by clicking on the Forgot Username option, located directly under the login fields on either the desktop or mobile app. From the Account Recovery page, select the Forgot Username Tab located directly under Account Recovery:

- Enter your Member Number (not your account number).

- Enter your Last Name.

- Enter your Date of Birth.

- Enter your Social Security Number.

- Select the delivery target to receive your username.

- Click on Continue.

- You will receive an onscreen message that says your login retrieval was successful.

- You will receive your username based on the delivery target you chose.

If you continue to experience issues, please call us at (800) 839-1154.

I have locked myself out of my TDECU Digital Banking account. Is there a way to unlock my account?

Yes! If you are locked out, you have two options:

- Wait 1 hour from your last attempt to try again OR

- You may unlock your account immediately by using the Unlock Username Form.

You can do so by clicking on the Unlock/Forgot Username option, located on the bottom right of the login page. From the Account Recovery page:

- Enter your Member Number (not your account number).

- Enter your Last Name.

- Enter your Date of Birth.

- Enter your Social Security Number.

- Enter your locked username.

- Click on continue.

- You will receive an onscreen message that says your account recovery unlock was successful.

If you continue to experience issues, please call us at (800) 839-1154.

What is my Member Number?

Your Member number is the number used to identify you as a Member of TDECU. All of your relationships with TDECU fall under this number. To find your Member number, you can log in to Digital Banking. Alternatively, you may locate your Member number on your monthly account statement or stop by any TDECU Member Center location for assistance.

How do I notify TDECU of my upcoming travel plans?

For credit cards, please log in to Digital Banking and use the travel notifications option under Manage Cards. For debit cards, notify TDECU at least two business days before your departure by sending Member Care a secure message in Digital Banking, or calling the number on the back of your card and providing the dates of your travel and the destination.

I received a letter about escheatment. What does this mean?

If you have not conducted a transaction on your account or contacted us within the past three years, we are required to set your account to dormant status. The state of Texas regulates unclaimed property, including inactive accounts with balances and safe deposit boxes. For more information on how to keep your account active or locate unclaimed property, please click here.

To view additional questions, please visit our Frequently Asked Questions page.

Advice Center

Contact Information

Debit cards

Member service: (800) 839-1154

Reset your PIN: (855) 898-7287

Credit cards

Lost or stolen cards: (866) 572-4135

Member service: (877) 404-1009

Mobile wallets: (855) 553-4291

Disputes or fraud: (888) 918-7341

Credit Card PIN: (888) 886-0083

Mortgage

Purchase or refinance: (877) 774-2657

Loan servicing: (800) 839-1154 Ext.4617

Business & Commercial Services

(800) 839-1154 Ext. 4618

TDECU Insurance, LLC1

(888) 833-7358

TDECU Wealth Advisors2

(877) 635-7028

Telephone Banking System

(800) 839-0420

Make a loan payment

(877) 255-1400

1TDECU Insurance Agency, LLC is a wholly-owned subsidiary of Texas Dow Employees Credit Union. TDECU Insurance Agency, LLC and Texas Dow Employees Credit Union are not affiliates of the insurance companies represented. Insurance products are not deposits; not NCUA insured; and not guaranteed by TDECU Insurance Agency, LLC or Texas Dow Employees Credit Union.

2Securities offered through LPL Financial, member FINRA/SIPC. Insurance products offered through LPL Financial or its licensed affiliates. TDECU and TDECU Investments are not registered broker/dealers and are not affiliated with LPL Financial. Investment Advisory Services offered through LPL Financial, a Registered Investment Advisor. The investment products sold through LPL Financial are not insured TDECU deposits and are not NCUA insured. These products are not obligations of TDECU and are not endorsed, recommended or guaranteed by TDECU or any government agency. The value of the investment may fluctuate, the return on the investment is not guaranteed, and loss of principal is possible. State Disclosure - The LPL Financial representative associated with this website may discuss and/or transact securities business only with residents of the following states: Texas.