Stronger Together

We're committed to you after the storm, providing financial support to help restore your peace of mind

Remember the following before visiting your local Member Center

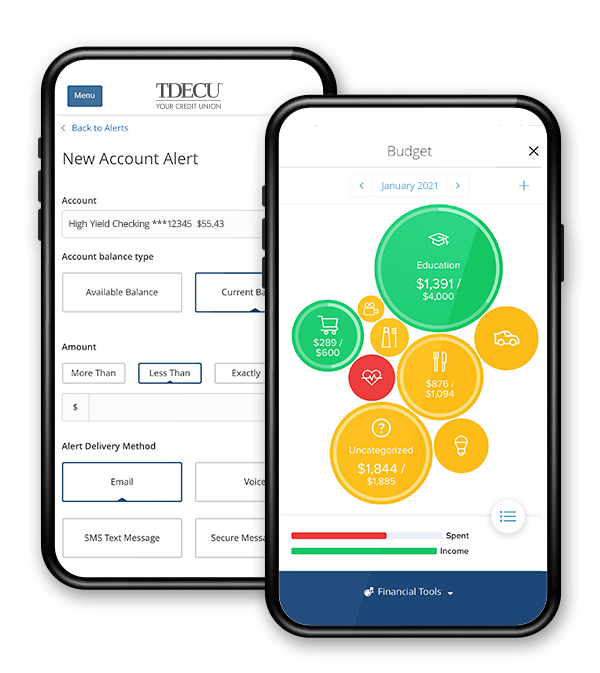

Bank from anywhere with TDECU Digital Banking

Our online and mobile banking solution offers a convenient way to manage a wide range of transactions without leaving your home. TDECU Digital Banking allows you:

- Check balances and account history

- Pay bills

- Deposit checks with the mobile app

- Transfer money between accounts

- Track spending and create budgets

- Manage your TDECU credit card

- Securely message us

- Find your nearest surcharge-free ATM

*Credit approval required. See TDECU for complete details. Insured by NCUA.