A growing number of Americans have been forced to delay their planned retirement date due to job and savings losses suffered during the past recession. Postponing retirement not only means working longer but also delaying when you start collecting Social Security.

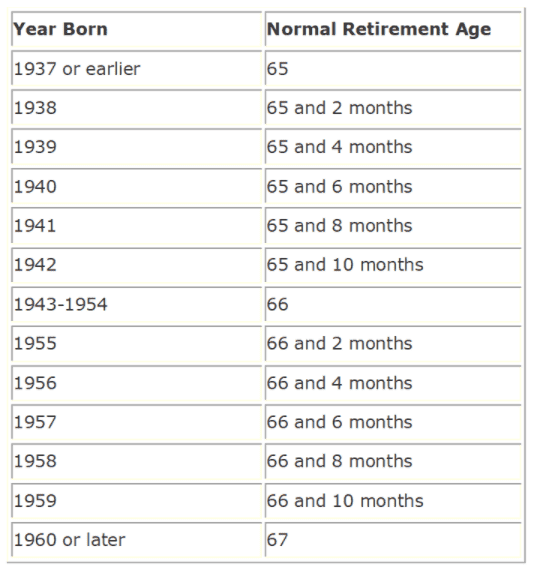

Currently, workers can begin collecting Social Security as early as age 62 and as late as age 70. The longer you wait to start collecting, the higher your monthly payment will be. Your Social Security monthly payment is based on your earnings history and the age at which you begin collecting compared with your normal retirement age. This normal retirement age depends on the year you were born.

Those choosing to collect before their normal retirement age face a reduction in monthly payments by as much as 30%. What's more, there is a stiff penalty for anyone who collects early and earns wages in excess of an annual earnings limit.

For those opting to delay collecting until after their normal retirement age, monthly payments increase by an amount that varies based on the year you were born. For each month you delay retirement past your normal retirement age, your monthly benefit will increase between 0.29% per month for someone born in 1925 to 0.67% for someone born after 1942.

Which is right for you will depend upon your financial situation as well as your anticipated life expectancy. Anyone with a good pension or substantial savings may want to delay a bit. Similarly, if you're in no hurry to retire, you may want to continue working longer and collect later.

Likewise, those with a family history of longevity who expect to live a long time stand to gain more by delaying. If you think you're unlikely to survive beyond age 78, you may want to start collecting at age 62. And if you expect to survive beyond age 82, you might consider a delayed collection.

Whenever you decide to begin collecting, keep in mind that Social Security represents only 33% of the aggregate income of retirees.1 So you'll need to save and plan ahead -- regardless of whether you collect sooner or later.

Source/Disclaimer:

1Source: Social Security Administration, Fast Facts & Figures About Social Security, 2017, September 2017.

Required Attribution Because of the possibility of human or mechanical error by DST Systems, Inc. or its sources, neither DST Systems, Inc. nor its sources guarantees the accuracy, adequacy, completeness or availability of any information and is not responsible for any errors or omissions or for the results obtained from the use of such information. In no event shall DST Systems, Inc. be liable for any indirect, special or consequential damages in connection with subscriber's or others' use of the content.

© 2019 DST Systems, Inc. Reproduction in whole or in part prohibited, except by permission. All rights reserved. Not responsible for any errors or omissions.

1-926979