Membership

What it means to be a TDECU member

We take membership personally

Making the decision on where to move or begin your financial relationship is an important one. Ideally, this is a long-term relationship you are starting, so it’s important to make sure it is the right fit for you. When you join TDECU, you will belong to a community of more than 354,000 members who count on us each day to be part of their lives, both financially and personally. You see, we understand that one is not independent of the other. In order to best support our members, we must know them on a personal basis in order to serve them well financially. We want to know your financial goals and dreams in order to find the products and services we know will help you get there.

We understand that life sometimes takes unexpected turns that create challenges for which you aren't prepared. For more than 65 years, we've stood side-by-side with our members during their most difficult of times, both personally and financially to get them back on their feet. We want to create independence for our members; we want to help our members pursue their dreams, to better grow their own lives and the lives of those they love. We invite you to join us.

The credit union difference

Are you looking for better rates, higher quality service, and the benefits an owner deserves? Become a member of TDECU today and get in the credit union habit!

Let’s face it: traditional banks are broken. With high fees, poor customer service, and cookie-cutter financial products and services that aren’t tailored to customer needs, banks have lost touch. No wonder why thousands all over the country make the switch yearly.

TDECU is a not-for-profit financial cooperative where you are an owner, which means there are no big corporate stockholders looking for a return. Instead we pass the profits on to you, our members, in the form of lower fees and higher deposit rates.

Additional membership benefits

- Great rates

- Checking that earns interest

- Free digital banking, and bill pay

- Free accidental death & dismemberment (AD&D) insurance

- Website tools to help you make decisions

- Free Access to over 55,000 surcharge-free ATMs across the United States

- 24/7 service at 800-839-1154

- Special offers and discounts

- 39 service locations including 35 Member Centers

It's easy to become a member!

Who can join?

Anyone over the age of 18 who meets one of the following:

- is a family member of a current TDECU member

- lives within a 10 mile radius from a TDECU Member Center

- is an employee, retiree or family member of an employee of a company TDECU serves

- is a member of an organization TDECU serves

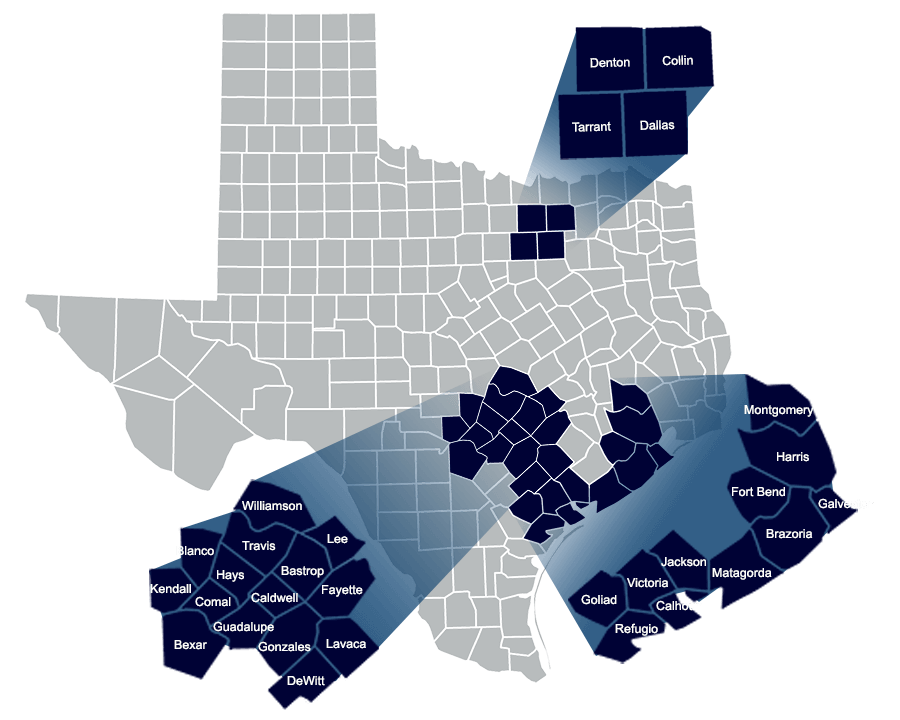

- lives, works, worships or attends school in one of the following counties:

- Bastrop

- Bexar

- Blanco

- Brazoria

- Caldwell

- Calhoun

- Collin

- Comal

- Dallas

- Denton

- DeWitt

- Fayette

- Fort Bend

- Galveston

- Goliad

- Gonzales

- Guadalupe

- Harris

- Hays

- Jackson

- Kendall

- Lavaca

- Lee

- Matagorda

- Montgomery

- Refugio

- Tarrant

- Travis

- Victoria

- Williamson

If your county is not listed, you may contact Member Care at 800-839-1154 or visit a TDECU Member Center to learn if you qualify.

TDECU will fund $5 for your new savings account and $1 into your new checking account to give you all the benefits of membership! Use our online application to open your savings account and you can open your checking account at the same time. You can easily fund your accounts with a transfer from your current bank or with a debit/credit card. Once your accounts are open, you can immediately enroll in Digital Banking. It's that simple.

What do I need to join online?

- Social Security Number

- U.S. Driver's license, U.S. State-issued ID or Passport

- Email address

- If funding by electronic check, your current bank ABA routing and account numbers

- If funding with a debit or credit card, your card number, expiration date and CVV code

- Previous address information

- Information for any joint account holder

- Ability to view PDF documents (Download Adobe Reader)