Security Technology

Together, we can protect your information

Our commitment to you

TDECU is committed to maintaining the privacy and security of your personal and private information when submitted via TDECU.org. TDECU uses firewalls that act as a shield between the internet and TDECU's internal systems. These barriers help to ensure that all internal information is secure.

Tips to protect identity and bank accounts

In Digital Banking, our system encrypts all of your information making it unreadable, especially during transmission. For your security and ours, TDECU uses robust, industry-standard encryption. When you log in to Digital Banking your unique Member ID and password are encrypted using Secure Sockets Layer (SSL) technology. This necessary precaution is intended to deter anyone other than yourself and TDECU from accessing your personal information.

While we work very hard to protect and secure your accounts, you also have a very important role to play in preventing unauthorized activity on your account:

- To help protect any information that you enter into your computer, we highly recommend that you install security software on your personal computer (PC), including anti-virus software, a firewall and spyware detection software.

- Do not write down or share your log in credentials or any other personal information.

- Although TDECU may contact you by email from time to time, we will never ask you to send us your personal or account related information via e-mail. If you receive a suspicious email, please report it to emailfraud@tdecu.org immediately.

- Never provide personal information in response to unsolicited text messages, emails or telephone calls – even if they appear to be from a legitimate business. You should never click on links provided in unsolicited e-mails or text messages. TDECU does not send unsolicited electronic messages asking you for your personal information.

- If you wish to contact TDECU via email, never include any personal information such as member number, passwords, Social Security Number, birth date or any other personally identifiable information.

Tips to report suspicious activity

If you have any questions about the validity of communication that claims to be from TDECU or another financial institution, you should contact the institution immediately by telephone or in person. If a scammer does take advantage of you online, report it to the Federal Trade Commission at ftc.gov. The FTC enters Internet, identity theft and other fraud-related complaints into Consumer Sentinel, a secure, online database available to hundreds of civil and criminal law enforcement agencies in the U.S. and abroad. If you receive deceptive email, such as a message “phishing” for your information, forward it to the entity that is being wrongfully impersonated (for TDECU-related phishing emails, forward to emailfraud@tdecu.org.) Be sure to include the full header of the email, including all routing information. The Anti-Phishing Working Group, a consortium of Internet Service Providers, security vendors, financial institutions and law enforcement agencies, uses these reports to fight phishing.

Be cautious with text messages

If you receive a text message that claims your credit union debit card has been or will be deactivated for security reasons, this message is fraudulent and an attempt to steal your identity. These text messages may claim that you must call an 800-number and provide personal information to reactivate your cards. Assume unsolicited text messages are fraudulent. Become familiar with the customer communications policies of businesses you use. Upon receipt of an unsolicited text message, call the actual business at a telephone number that appears on a statement, a credit card, or the telephone directory.

Mobile banking security tips

When you use a mobile device for account access, keep these tips in mind:

Use the keypad lock or phone lock function on your mobile device when it is not in use.

These functions password-protect your device to make it more difficult for someone else to view your information. Also be sure to store your device in a secure location.

Keep your passwords safe.

Never disclose via text message, phone call or email your personal or financial information, including member number, passwords, Social Security number or birth date. If you lose your mobile device or change your mobile phone number, remove the old number from your digital banking profile by calling Member Care at 800-839-1154.

Downloading mobile apps

Applications (apps) are programs you can download to your mobile device. Applications or "apps" that let you monitor your finances and conduct certain transactions are increasing in popularity. Only download mobile apps from reputable sources to ensure the safety of your personal and account information.

Keep your apps up-to-date

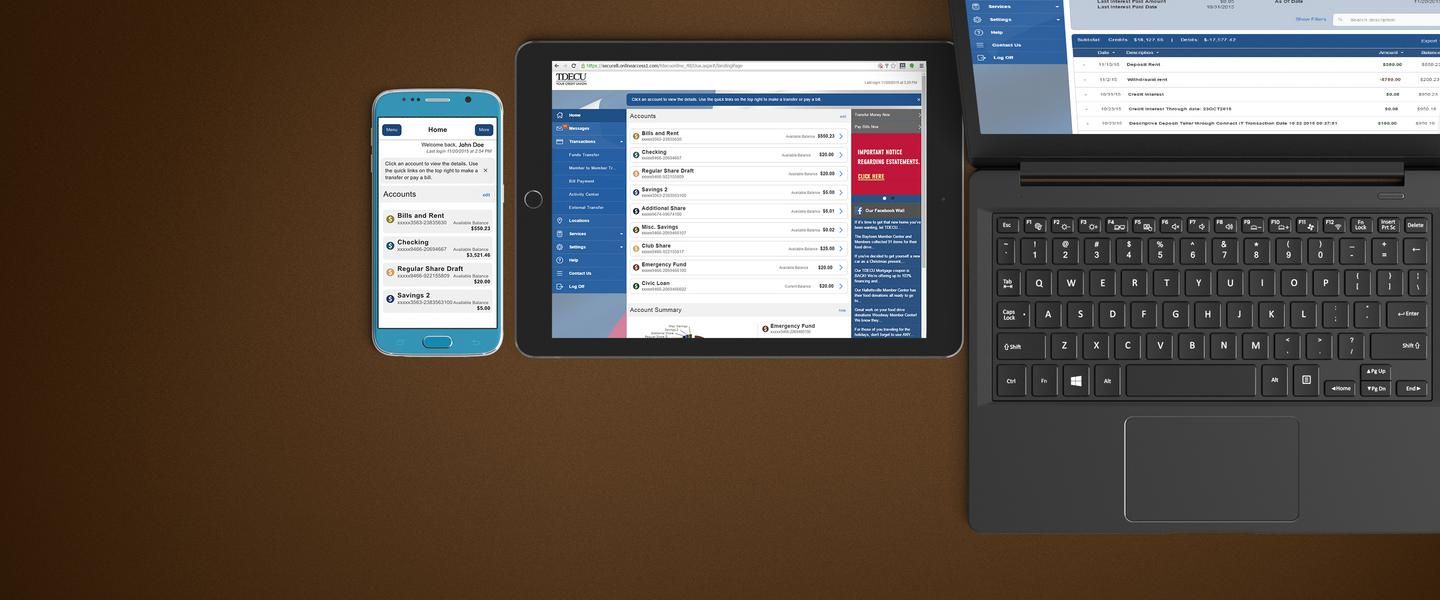

We encourage users to download the most recent versions of TDECU apps and keep them updated. Our apps are supported by Android and iPhone devices. You can download the TDECU digital app by visiting the associated App Store and searching for "TDECU" or visit tdecu.org and use our download links.

Logout when you're finished

For your security, sign off when you finish using a TDECU app rather than just closing it. If you have suspicions about the authenticity of a TDECU digital banking app, access your account through our digital banking site at tdecu.org.